Table of Content

Sure, this means Wall Street, but non-market forces can also influence mortgage rates. Changes in inflation and unemployment rates tend to put pressure on interest rates. The mortgage rate a lender offers you is determined by a mix of factors that are specific to you and larger forces that are beyond your control. Home equityis the difference between the balance owed on your mortgage and your home’s current market value. Simply put, it’s the share of your house that you own because you’ve paid down your mortgage balance and/or your property’s value has increased over time. Lenders usually don’t want you to spend more than 31% to 36% of your monthly income on principal, interest, property taxes and insurance.

Performance information may have changed since the time of publication. Back-end DTI adds your existing debts to your proposed mortgage payment. Let’s say your car payment, credit card payment and student loan payment add up to $1,050 per month. Your proposed housing payment, then, could be somewhere between 26% and 35% of your income, or $1,820 to $2,450. A lender will run a hard credit check to look at your current score and the last several years of your credit history. Keep in mind that mortgage lenders look at a score from all three credit bureaus, which could be different than the FICO score you see on free score checking websites.

Interest Rate Type

Talk with local experts in your home shopping area to get a better sense of the market. Getting a mortgage is the most important part of the homebuying process. So finding the right lender and getting the best deal can save you thousands of dollars over the life of the loan.

When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. Mortgage rate lockis the lender's guarantee that you'll pay the agreed-upon interest rate if you close by a certain date. Your locked rate won't change, no matter what happens to interest rates in the meantime. To see more personalized rates, you'll need to provide some information about you and about the home you want to buy. For example, at the top of this page, you can enter your ZIP code to start comparing rates.

What is a good mortgage rate in today’s market?

They offer a no-down-payment solution for borrowers who purchase real estate in an eligible rural area. To qualify, your income must be at or below the local median. Historically speaking, borrowers with higher credit scores are less likely to default on their mortgages, so they qualify for lower rates.

Your monthly payment amount will be greater if taxes and insurance premiums are included. Good and bad interest rates depend on your personal financial situation. A bad interest rate for one borrower could be a great rate for another. To get the best rate for someone with your credit profile, be sure to shop around with at least three different lenders.

When is the right time to get a mortgage?

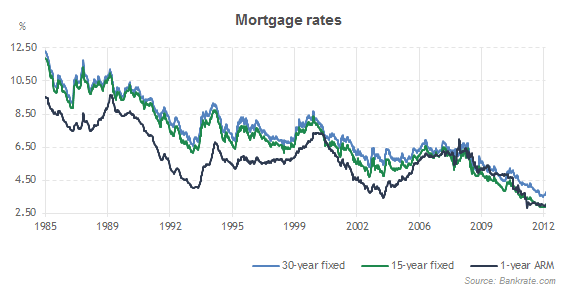

This can be a good option if you feel ARM rates are likely to stay lower than fixed rates in the future. For example, the 30-year fixed rate has dramatically increased since the start of 2022, which has made the ARM rate a lower, more attractive option right now. Compare refinance rates and do the math with Bankrate's refinance calculator. Interest rate – This is simply the percentage rate paid over the life of the loan.

Be sure to apply with several lenders so you can compare Loan Estimates and find your best deal. Often, you pay 1% of the loan amount to reduce your interest rate by about 0.25 percent. So, on a $200,000 loan, you might pay $2,000 to reduce your 6% rate offer to 5.75 percent. Why did stocks tumble after the Fed did pretty much exactly what the market thought it would? It's not about today's rate hike, according to one investment strategist. It's because the Fed signaled in its economic projections that more rate increases are coming than investors anticipated due to persistent inflation...which isn't falling as quickly as hoped.

Jumbo loans

Things can directly impact the specific interest rate you’ll qualify for. This link takes you to an external website or app, which may have different privacy and security policies than U.S. We don't own or control the products, services or content found there. Kate writes about mortgages, homebuying and homeownership for NerdWallet. Previously, she covered topics related to homeownership at This Old House magazine.

A mortgage point is most often paid before the start of the loan period, usually during the closing process. Each mortgage point typically lowers an interest rate by 0.25 percentage points. For example, one point would lower a mortgage rate of 6 percent to 5.75 percent. NerdWallet’s daily mortgage rates are an average of the published annual percentage rate with the lowest points from a sampling of major national lenders.

A lot of first-time homebuyer programs — such as statewide and local down payment assistance — can help you come up with a bigger down payment. You can do things to improve your personal finances before applying for a mortgage loan. According to research from the Consumer Financial Protection Bureau , almost half of consumers do not compare quotes when shopping for a home loan, which means losing out on substantial savings.

You’ll likely owe more when you close on the house than just the down payment on the mortgage. There are other expenses that have to be paid to make this big transaction go through. Finding the best home mortgage rate is a matter of knowing your goals and picking the right tool to get the job done.

A home equity loan allows a homeowner to borrow against the equity in their home and take the cash in a lump sum. The loan is often used to make major home improvements or toconsolidate credit card debt. A home equity loan, unlike a home equity line of credit , has a fixed interest rate, so the borrower's monthly payments stay the same during the term, which can be up to 30 years.

With a lock, the borrower doesn’t have to worry if rates go up between the time they submit an offer and when they close on the home. The greater share of the home’s total value you pay upfront, the more favorably they view your application. The kind of mortgage you choose can affect your rate, too, with shorter-term loans like 15-year mortgages typically having lower rates compared to 30-year ones. Conventional loans are often ultimately bought by Fannie Mae or Freddie Mac, the big government-sponsored enterprises that play an important role in the mortgage lending market. They are offered by virtually every type of mortgage lender, with some programs allowing for a down payment as low as 3 percent. A conventional loan can be either conforming or nonconforming; the conforming loans are the ones backed by the GSEs.

Before you apply for a mortgage, you should have a proven reliable source of income and enough saved up to cover the down payment and closing costs. If you can save at least 20% for a down payment, you can skip paying for private mortgage insurance and qualify for better interest rates. While mortgage rates don’t track the Fed’s rate hikes in the same way as other short term products, like home equity lines of credit , they do respond to inflation. Along with mortgage interest rates, each lender has fees and closing costs that factor into the overall cost of the home loan. When choosing a lender, compare official Loan Estimates from at least three different lenders and specifically pay attention to which have the lowest rate and lowest APR. This will help you feel confident you are getting the best deal.

The final day of closing is when you’ll sign the dotted line, take the keys to your new home, and officially have a mortgage. Loan application in that it doesn’t affect your credit and doesn’t guarantee you’re approved. Federal Reserve Chairman Jerome Powell said in September that a “difficult correction” may be necessary for the housing market, which has been out of balance due to limited supply and high demand.

No comments:

Post a Comment